PRODUCTS

Digital Asset Management

LiquidFi creates a unique Digital Asset for each underlying loan. This Digital Asset is a replica of the original loan and allows us to attach data, payments, and transactions throughout the life of the loan.

Unique Identifier

Each Digital Asset has its own customizable identifier or ticker.

Unique Loan

Digital Assets are backed by a single loan, not commingled with other loans.

Issuance Amount

Digital Assets are issued with the original balance of the loan, then adjusted for principal payments.

PRODUCTS

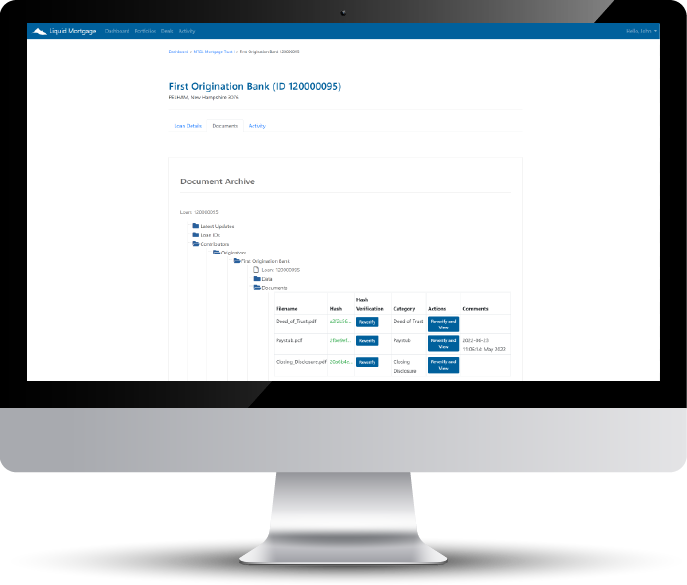

Liquid Archive

Partnering with Originators, Investors, Servicers, and Third-Party Review

(TPR) firms, a Liquid Archive is created for each loan. Data and documents

are captured in the Archive, then attached to the Digital Asset on a blockchain.

The Liquid Archive product can be tailored to Origination, Due Diligence,

Servicing, Service Provider, and Borrower documents.

Verifying Completeness and Originality of loan files has never been easier!

Contributor-Linked

Data and Documents are aggregated by Contributor for future validation and access.

Permissioned

Data and Documents are only available to permissioned parties by each Contributor.

Hashed for Validation

LiquidFi hashes each individual Archive document for future validation.

PRODUCTS

Liquid Verify

Continuous monitoring of Liquid Archive contents enables relevant parties to know when changes occur. Our algorithm confirms the location, existence, ownership, and originality, on an ongoing basis.

Verify customers have the ability to schedule the frequency on which the verification process runs, and which portfolios or sub-sector of loans require verification.

Never be surprised by an incomplete loan file again!

Location

Document storage location is confirmed to exist at Contributor’s source.

Existence

Document existence is validated by reading from storage location.

Originality

Document originality is confirmed based on a proprietary algorithm comparing Liquid Archive records.